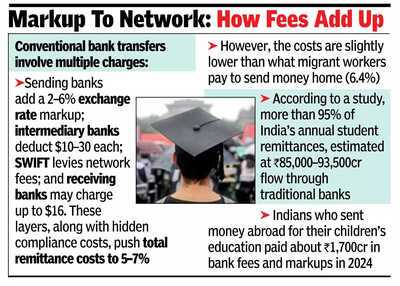

MUMBAI: Families sending money abroad to support their children’s education paid an estimated Rs 1,700 crore ($200 million) in bank fees and currency markups in 2024, a report released by Redseer Strategy Consultants and Wise , a global cross-border payments company, showed.

According to the study, more than 95% of India’s annual student remittances, estimated at Rs 85,000–93,500 crore ($10–11 billion), flow through traditional banks, which typically apply a 3–3.5% exchange rate markup and take between two and five days to complete transactions.

Families remitting Rs 30 lakh annually can lose up to Rs 75,000 in hidden costs. The estimates of the costs tie in with what World Bank has had to say on the cost of cross border remittances. The costs are slightly lower than what migrant workers in rich countries pay to send money home. According to World Bank, the global average cost of sending $200 was 6.4% of the amount sent, a slight increase from 6.2% a year earlier.

Digital remittances are significantly cheaper, averaging 5% in fees, compared with 7% for non-digital methods. This global cost remains well above the UN Sustainable Development Goal target of 3%, which aims to make remittances more affordable for migrants and their families.

Wise, which sponsored the study and competes with banks on international money transfers, has an interest in drawing attention to these inefficiencies. Unlike banks that route money through multiple intermediaries, Wise maintains local pools of funds at both ends of the payment corridor. When a sender transfers money, the company uses domestic systems to disburse an equivalent amount to the recipient after receiving confirmation that funds have arrived on the sending side. This method allows Wise to offer faster transfers, at the mid-market exchange rate without markup.

Conventional bank transfers involve multiple charges: sending banks add a 2–6% exchange rate markup; intermediary banks deduct $10–30 each; SWIFT levies network fees; and receiving banks may charge up to $16. These layers, along with hidden compliance costs, push total remittance costs to 5–7%, which often go unnoticed.

“The stories and the sheer scale of money lost to opaque pricing should be a wake-up call,” said Taneia Bhardwaj, south Asia expansion lead at Wise.

Since launching in India in 2021, Wise has seen education-related payments account for 75% of its volume from the country.

According to the study, India has emerged as the largest source of international students in the US, overtaking China in 2024. Indians make up 30–35% of international student populations in the US, the UK, Canada, Australia and Germany, which is up from 11% a decade ago. With overseas education spending by Indian households expected to double by 2030, the cost of remitting funds will become increasingly material.

According to the study, more than 95% of India’s annual student remittances, estimated at Rs 85,000–93,500 crore ($10–11 billion), flow through traditional banks, which typically apply a 3–3.5% exchange rate markup and take between two and five days to complete transactions.

Families remitting Rs 30 lakh annually can lose up to Rs 75,000 in hidden costs. The estimates of the costs tie in with what World Bank has had to say on the cost of cross border remittances. The costs are slightly lower than what migrant workers in rich countries pay to send money home. According to World Bank, the global average cost of sending $200 was 6.4% of the amount sent, a slight increase from 6.2% a year earlier.

Digital remittances are significantly cheaper, averaging 5% in fees, compared with 7% for non-digital methods. This global cost remains well above the UN Sustainable Development Goal target of 3%, which aims to make remittances more affordable for migrants and their families.

Wise, which sponsored the study and competes with banks on international money transfers, has an interest in drawing attention to these inefficiencies. Unlike banks that route money through multiple intermediaries, Wise maintains local pools of funds at both ends of the payment corridor. When a sender transfers money, the company uses domestic systems to disburse an equivalent amount to the recipient after receiving confirmation that funds have arrived on the sending side. This method allows Wise to offer faster transfers, at the mid-market exchange rate without markup.

Conventional bank transfers involve multiple charges: sending banks add a 2–6% exchange rate markup; intermediary banks deduct $10–30 each; SWIFT levies network fees; and receiving banks may charge up to $16. These layers, along with hidden compliance costs, push total remittance costs to 5–7%, which often go unnoticed.

“The stories and the sheer scale of money lost to opaque pricing should be a wake-up call,” said Taneia Bhardwaj, south Asia expansion lead at Wise.

Since launching in India in 2021, Wise has seen education-related payments account for 75% of its volume from the country.

According to the study, India has emerged as the largest source of international students in the US, overtaking China in 2024. Indians make up 30–35% of international student populations in the US, the UK, Canada, Australia and Germany, which is up from 11% a decade ago. With overseas education spending by Indian households expected to double by 2030, the cost of remitting funds will become increasingly material.

You may also like

Donald Trump makes bombshell U-turn by ordering release of ALL Epstein files

What is The Resistance Front? Lashkar's proxy who claimed responsibility for Pahalgam attack; now, a US designated terror group

Prosenjit Chatterjee says, 'Devi Chowdhurani' is part of India's cultural conscience

Can Former Xiaomi Exec's Startup Lumio Reboot The Indian Smart TV Market?

Lenskart Adds Smart Glasses To Cart, The Stock Broking Gold Rush & More