The RMG ban is creating ripples far beyond the gaming industry itself. UPI payments took a hit in August while the ban abruptly cut off a lucrative revenue stream for thousands of content creators. So, how deep is the cut?

UPI Flickers: As per NPCI data, UPI transactions under the “Digital Goods: Games” category declined 23% YoY to 27.1 Cr in August, while the value plunged 36% YoY to INR 7,441.1 Cr. What’s boggling is that the data only captures just 10 days of impact, suggesting September figures could show a far steeper decline as the full month effect materialises.

Fintech Fallout: The rampage extends deep into India’s fintech sector. With 80% of RMG transactions routed through UPI, payment companies are bracing for significant revenue losses. Industry insiders see INR 30,000 Cr in annual transaction volume losses, potentially shrinking UPI growth by 2% in volume and 0.5% in value.

Making matters worse is the fact that the yet-to-be-notified online gaming Act has left the entire fintech industry fumbling for clarity and compliance timelines.

Creators Cry Hoarse: The ban has overnight dried up the income of 32,000 creators, who were actively posting RMG-related content. As if this were not enough, the estimated INR 8,000 Cr spent by RMG platforms on digital advertising in the last six years has gone down the drain, while the broader online ad industry is bracing for a major slowdown.

The RMG Capitulation: The new mandate that bans RMG has left much destruction in its wake. All major players have shut RMG operations and pivoted to new business models, most have laid off employees en masse, and some have knocked on the doors of courts for reprieve.

And before the dust could even settle, the RMG ban triggered a domino effect that has upended the fate of many.

From The Editor’s DeskPharmEasy’s Mixed FY25: The online pharmacy managed to slash its losses by 40% to INR 1,517 Cr in FY25 from INR 2,522 Cr in the previous fiscal year. Operating revenue remained flat and grew a mere 3.6% YoY to INR 5,872 Cr in the fiscal under review.

Zupee’s Short Video Pivot: The gaming platform is pivoting to short video content following the ban on real money gaming. The company began piloting the offering last week and will monetise the product through subscriptions. It is also mulling a new astrology platform.

PayU Eyes $300 Mn: The Prosus-owned fintech major is looking to raise $250 Mn to $300 Mn ahead of its public listing. With this, the startup plans to diversify its cap table, gauge investor demand and set its IPO valuation benchmark.

Ultrahuman Recalibrates: Days after the company was banned from selling its smart rings in the US, the startup has submitted a redesigned version of its smart ring for review to US authorities. The shipments of the new products will begin by late October.

Indrajaal Nets INR 48 Cr: The defence tech startup has raised fresh funds in a round co-led by India Accelerator and Finvolve. The Hyderabad-based startup has built an AI-powered system that can autonomously protect an area against rogue drones.

Karnataka’s Quantum City: The state government has approved the allocation of 6.17 acres of land in Bengaluru’s Hesaraghatta to build a quantum city. The facility will host research labs, startup incubation centres and production clusters for quantum hardware and processors.

VCats Nets INR 150 Cr: The investment firm has raised the capital in a mix of primary and secondary deals from Ashish Kacholia, Authum Investments, angel investors and Bollywood actors. Venture Catalysts has over $500 Mn in AUM and has backed over 400+ startups.

Has Ola Electric Turned The Corner? After months of sputtering in neutral, the EV maker’s stock touched a seven-month high last week on the back of the PLI scheme boost and positive auto industry sentiment. So, what’s happening at Ola Electric these days?

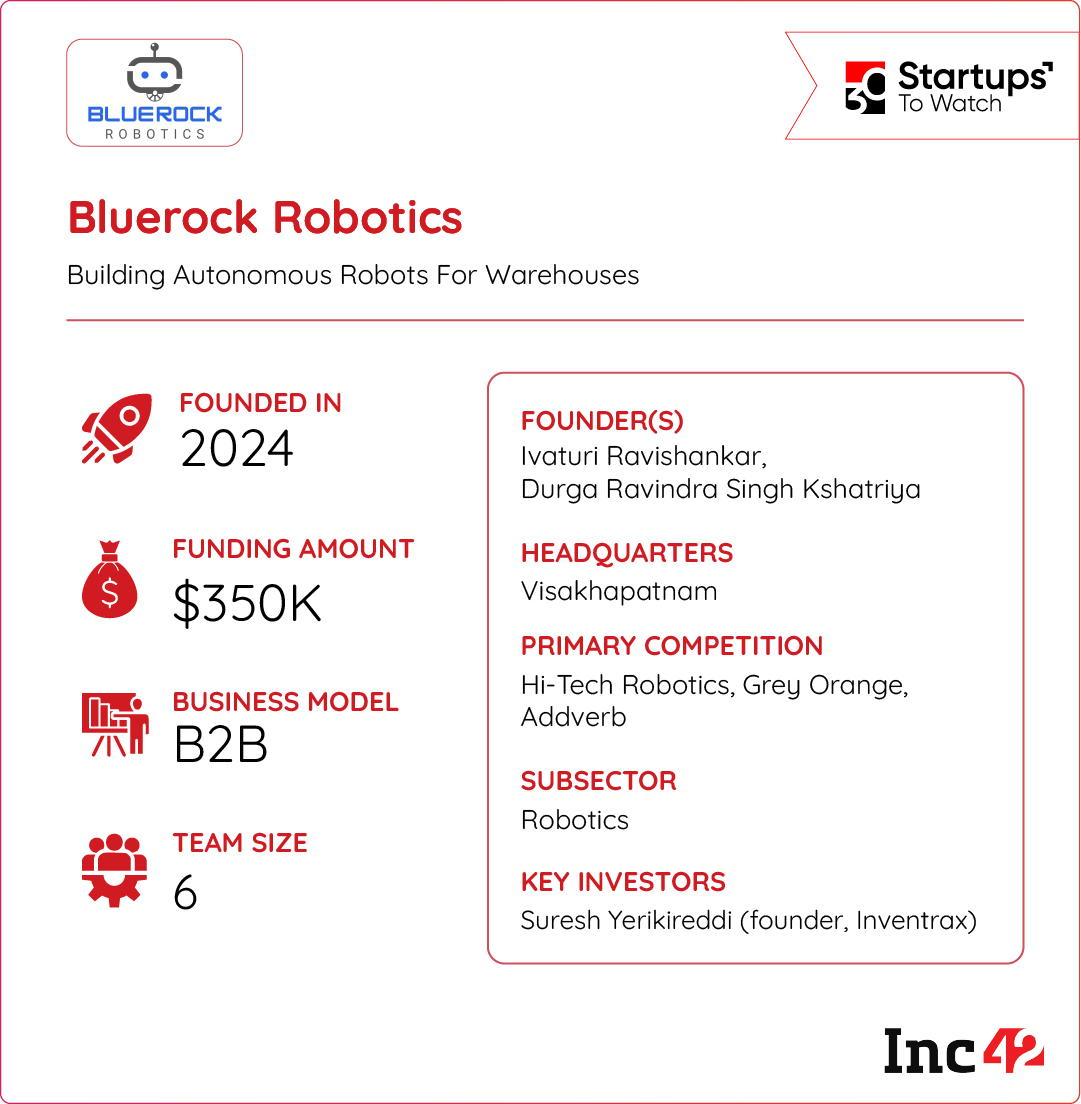

Inc42 Startup Spotlight Can Bluerock Automate India’s Warehouses?As consumers expect super-fast deliveries in the era of quick commerce, warehouses still rely heavily on human effort and repetitive manual tasks. This creates delays, increases costs, and limits scalability. Bluerock Robotics is solving this problem with its AI-powered autonomous robots.

Making Warehouses Intelligent: Founded in 2024, the deeptech startup designs and manufactures autonomous mobile robots (AMRs) and automated guided vehicles (AGVs). Its AMRs leverage advanced AI algorithms for real-time path planning, obstacle avoidance and task allocation to freely navigate within warehouse environments to increase efficiency.

Bluerock’s AGVs are specifically engineered for heavy-duty transport operations across fixed pathways within a warehousing unit.

The Flexible Playbook: Bluerock has opted for a flexible go-to-market strategy, offering their robotic solutions through both direct purchase and leasing models. This approach caters to diverse customer segments – from established enterprises with substantial capital budgets to growing ecommerce companies seeking operational efficiency without major upfront investments.

With the global warehouse automation market projected to become a $26.5 Bn market by 2034, can Bluerock Robotics automate the future of warehouse operations?

The post The RMG Ripples, Zupee’s Short Video Pivot & More appeared first on Inc42 Media.

You may also like

I found the perfect Christmas scent inside one luxury fragrance advent calendar

Badrinath Dham: Why do dogs not bark here? Mysterious temple and amazing natural rules!

Carlos Alcaraz's coach reveals edge he has over Jannik Sinner after his private request

Broccoli is much tastier if you turn it into a autumn soup that only costs £5 to make

Over 500 Wayanad people in trouble after outsiders exploit their bank accounts