Be it the bustling bazars of Bareilly in Uttar Pradesh or the colourful neighbourhoods of Jodhpur in Rajasthan, there is something about India’s tier II and III cities and towns that draws all of us in.

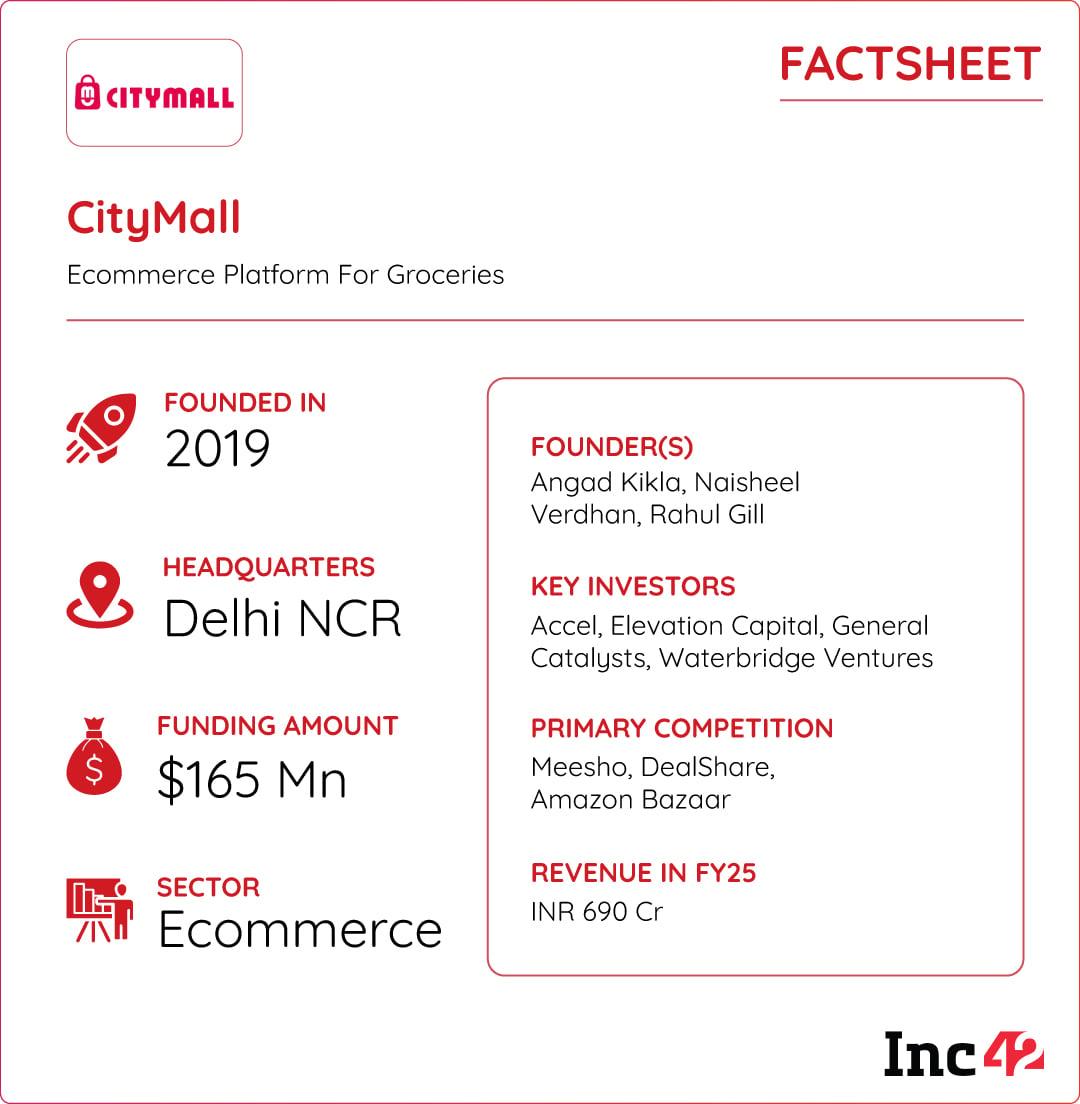

This charmed Citymall founders, Angad Kikla, Naisheel Verdhan and Rahul Gill, too, to make India’s small towns their playground when they launched the ecommerce platform, now dedicated to groceries alone, in 2019.

“While metros and tier I cities still dominated online consumption when we started, the real transformation was happening in tier II-III cities and towns, where real digital transformation was coming to life,” Kikla said, adding that he wanted to be part of just that.

Banking on this, the founders of CityMall have, within a few years, built an INR 700 Cr revenue-generating ecommerce platform that primarily delivers groceries.

Recently, CityMall secured$47 Mn in its Series D round led by Accel with participation from its existing backers Elevation Capital, WaterBridge Ventures, and General Catalysts. It has raised a total of $165 Mn since its inception.

However, much of its success that breathes in the regions where real India resides has been delayed. For one, had it not been for a few detours early on in their journey, the founders said, CityMall would currently be hitting the INR 1,000 Cr+ revenue mark.

However, what seemed like detours pivoted the trio of founders one step closer to where they stand with their venture today. “Every unexpected turn led us to the right road,” said Kikla.

But what exactly were the unexpected divergences the CityMall founders rarely talk about?

When Three Lefts Made A RightFounded in 2019, CityMall kick-started its journey as a social commerce platform. At the time, the concept of social commerce was selling like hot cakes, and everyone wanted to grab one. This was also the time when Meesho had already raised around $200 Mn, while names like DealShare and Simsim were on an expansion spree.

By 2021, Meesho had already become a unicorn, and DealShare in 2022. Simsim, however, got acquired by YouTube for $70 Mn.

In the pre-2020 era, social commerce spread like wildfire, which prompted the founders to increase their presence on various social media platforms and take orders on WhatsApp.

With a vision to eventually sell everything under the Sun, the founders began with low-cost electronics and general merchandise.

“Aspirations ran amok until the pandemic hit the world,” the founder said. All plans came to a standstill, and the business had to pivot overnight — from selling vanity to essentials.

“This was the first unexpected turn that we had to make,” Kikla said, adding that the entire journey of CityMall so far is precisely about three uncomfortable turns.

This moment also marked CityMall’s foray into groceries.

The First Left: The Grocery ForayCityMall’s maiden business model was dependent on group buying, which, as per Kikla, had its fair share of challenges.

“What we realised a year after the launch of CityMall was that group buying was not an easy game in India. No two people will ever ask for the same product at the same time.”

As Kikla was still trying to make sense of the group buying business model, the pandemic wreaked havoc. It was now time to call the shots — survive or perish.

“We chose to die another day,” Kikla exclaimed.

With little to ponder, the founders pivoted to essential services, especially grocery delivery, recognising it was the only way to stay afloat as Covid-19 brought the world to its knees.

As India endured the pandemic pains, along with the world, smaller cities and towns emerged as bigger casualties, with supply chains being impacted and neighbourhood kirana shops running out of inventory.

“India’s small towns and cities face a dire burden of broken infrastructure and last-mile connectivity. During the pandemic, the situation got even more gruesome due to stalled supply chains. We decided to step up and in,” Kikla said.

Leveraging their only warehouse in Gurugram, the founder spoke with distributors of FMCG giants for a stock-up. With fewer than 20 members in the team, Kikla was ready to make a real impact on the pandemic-ailing world.

But what about the product-market fit? Whom to sell? How to sell? Now, before these questions could result in sleepless nights, the founders decided to act.

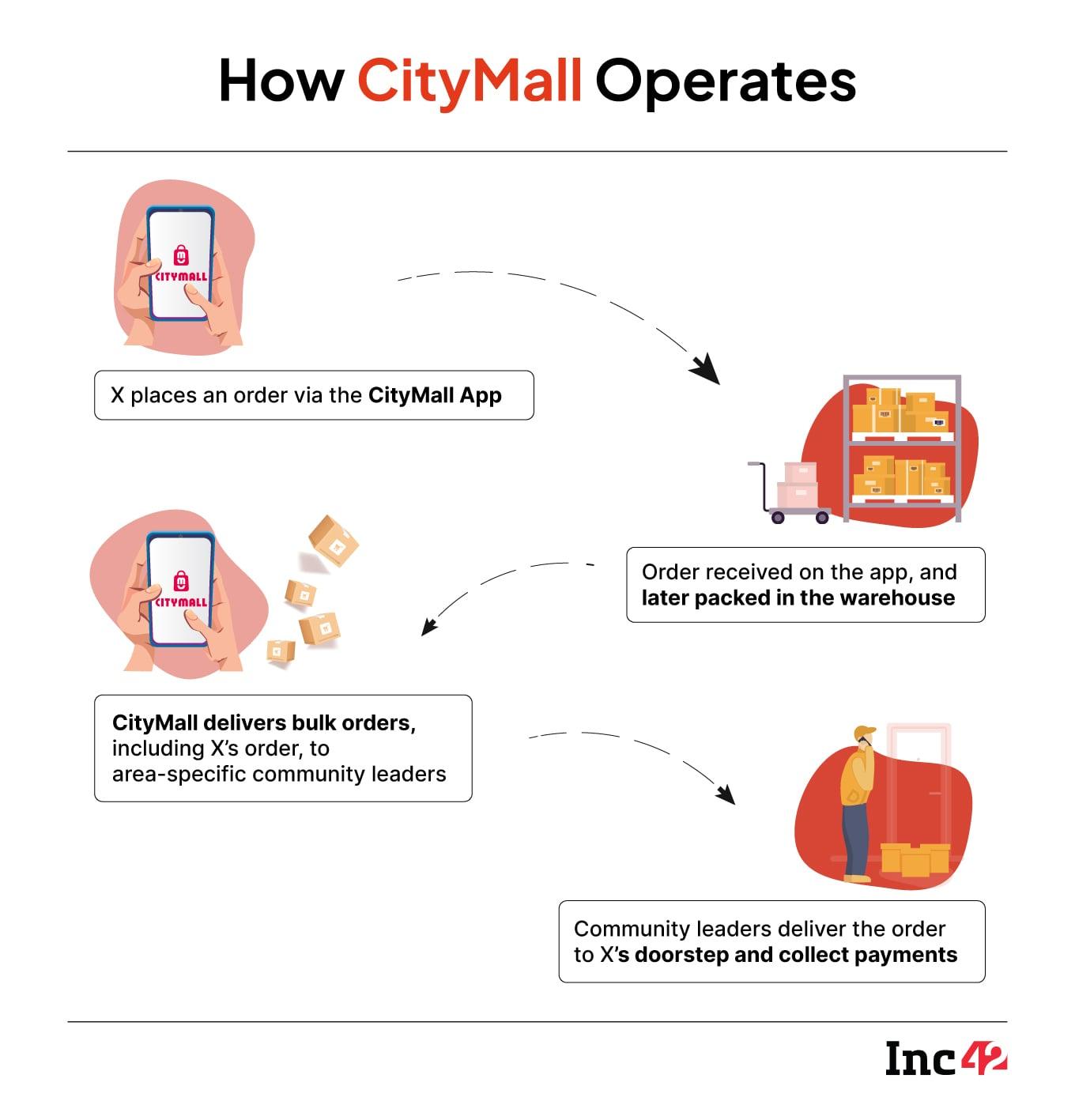

Instead of tying up with retail shops, they reached out to neighbourhood folks, like milkmen or vegetable sellers, who were already involved in supplying essential goods to households.

“With a monthly payout of INR 10,000, we onboarded them as community leaders. Their work was to take orders from families, alert us on WhatsApp, and deliver,” Kikla said.

The onboarding of community leaders of a particular region helped them fix the great supply chain divide breeding in smaller towns and villages.

The social commerce strategy worked, as they started raking in healthy revenues — enough to turn investors’ heads. By November 2020, the founders had raised $3 Mn, and then an additional $15 Mn in March 2021 from Accel Partners, Elevation Capital, among others.

The infusion helped strengthen the CityMall business. The founders added more warehouses to their stack, all while increasing the team size and vehicle fleet.

“We had (by 2021) become a team of 21 people who were covering parts of Delhi NCR and Harayan region, and a total of 10 cities and towns,” Kikla said. By the end of 2021, as many as 20,000 community leaders were working with CityMall, catering to 2 lakh customers.

As the world entered 2022, Indian startups woke up to a new reality – the unforgiving funding winter. Against the funding highs of 2020 and 2021, the year 2022 had already started making founders jittery as VCs tightened their purse strings.

On the one hand, the economy was showing signs of revival as the pandemic waned, and on the other hand, the waters of digital business models were being put to the test. Unsurprisingly, many failed, raising concerns among investors.

This was also the time when social commerce models started to disintegrate bit by bit due to never-ending cash burns on marketing and employees. During this time, Meesho was burning twice what it was making, and profitability was elusive.

Similar was the fate of other social commerce platforms, and CityMall was no exception.

Bucking the trend, even though Kikla and the folks were able to secure an additional $75 Mn in March 2022, the entire social commerce picturesque started losing its appeal.

Of course, the funding came with its own set of challenges. The founders were forced to cut costs due to aggressive growth, and this resulted in layoffs. In the next one year, the company had to let go of nearly 300 employees.

However, this was not the worst part. During this time, the extent of social commerce had started to hit saturation, and VCs could no longer see it as a viable business opportunity.

In the middle of 2022, Meesho started to wind down its social commerce vertical to cut costs, while DealShare underwent multiple rounds of layoffs, cofounder exited and the shutdown of its B2B arm. It was eventually taken over by investors.

The fate of Simsim, too, was not in favour, as YouTube pulled the plug on the social commerce company in March 2023.

Meanwhile, this was the second time Kikla doubted his decision and went to the drawing board again with other founders. “An entire social commerce sector was reeling under turmoil, and we, too, were part of the grind,” the founder said.

The next decision had to be swift, meaningful, bold and realistic, all at the same time.

The Third Left: The Localisation GameThe founders somehow kept their boat afloat until the end of 2023. While the revenues were growing, investors were no longer supportive of this vanity metric and expected to see some signs of profitability.

The startup’s operating revenue stood at around INR 10 Cr in FY21 versus a loss of 10.4 Cr. The operating revenue climbed to INR 130 Cr against a loss of INR 131 Cr in FY22. Further, while the top line skyrocketed to INR 300 Cr in FY23, the loss also increased to INR 145 Cr.

“The investor pressure was immense, and we were standing at yet another crossroads,” Kikla said, adding that the entire social commerce sector was winding down. “Although we did not wind down, we had to change the trajectory.”

Kikla said that they adopted a three-pronged strategy to change the entire game. Primarily, they focussed on shedding their dependency on WhatsApp-led order aggregation. To compensate for this, the founders upgraded the Citymall app, making it the core business focus.

Then, the founders rationalised the community leader ops by retaining the ones with a stronger local reach and bigger storage capacity. The strategy helped the business keep delivery costs to just INR 50 per order against an average order value of INR 450.

Finally, and the third turn, the founders launched their private labels, doubling their margins.

“Most retailers have a margin issue with FMCG brands. We solved this by procuring local brands, as well as building our lineup of high-demand products,” Kikla said.

Regional brands fetch 20-25% margins and private labels push this number up to nearly 40%, all while being affordable to end customers. Today, 65%-70% of CityMall’s revenue comes from regional and private-label products.

The strategy has worked brilliantly, as non-metro consumers are less brand-conscious but highly price-sensitive. “This pivot also helped us rebuild our business around affordability. The cheapest dal, floor cleaner, or a bottle of ketchup has to be on the CityMall app,” Kikla noted.

Result? CityMall’s GMV surged from INR 429 Cr in FY24 to INR 768 Cr in FY25. Adjusting for refunds, returns and discounts, which account for about 10-12% of CityMall’s GMV, the startup harvested an operating revenue of INR 690 Cr FY25 — although CityMall is yet to file its audited financial statements.

“With a revenue run rate of INR 100 Cr every month, we are on track to rake in INR 1,000 Cr in FY26,” Kikla said.

But the landscape is changing yet again, and at the centre of the new world order is the rise of quick commerce.

CityMall may be riding the ecommerce boom in tier II and beyond towns, but the rise of quick commerce platforms beyond tier I cities could be a threat to its core.

As opposed to CityMall’s 36-hour delivery timeline, quick commerce platforms promise instant gratification, usually delivering anywhere between 40 minutes and two hours.

And now giants like Blinkit and Swiggy Instamart are upping the ante to capture India’s tier II and III cities and towns. CityMall’s market is at stake here, unless it pivots again or at least gives quick commerce a deeper thought.

“Quick commerce has yet to make a headway in smaller towns.” As per his rationale, only 15% of CityMall’s users also transact on quick commerce platforms.

However, given the growth of quick commerce in the country, this percentage of users is only expected to flourish in the near future.

The reason is simple — quick commerce caters to the impulse, which CityMall does not. In contrast, CityMall positions itself as a platform for monthly or bi-monthly high-volume stock-ups.

“We have created our niche in price-sensitive, low-urgency purchases. When people want to ration for a whole month, they look at us for the best prices… and that’s exactly where we beat speed,” Kikla explained.

While Kikla has a point here, a pressing question is whether CityMall’s price-led differentiation is a moat deep enough to defend it from giants who can burn and offer freebies of any extent to win a particular market.

“Come what may, quick commerce is not on the cards,” Kikla said. Well, while that settles CityMall’s ecommerce-to-quick commerce transition debate — we still feel that there is a fourth turn awaiting Kikla and his cofounders around the corner as quick commerce grips the country with its gauntlet of instant gratification.

Edited By Shishir Parasher

The post CityMall’s Many Left Turns Into The INR 1,000 Cr Revenue Club appeared first on Inc42 Media.

You may also like

'Heartbreaking but inevitable': Ben & Jerry's co-founder resigns; did Israel-Gaza play a role?

Boy, 7, tragically dies two years after complaining of severe tummy ache

ECI issues revised guidelines for design, printing of EVM ballot papers; sends letter to CEOs of States/UTs

Snubbed by Calcutta HC, Bengal govt sanctions Rs 50 crore for lower and district court infra

UK households told to put lemon peel in dishwasher for important reason