New Delhi: India's goods and services tax (GST) revenues have remained robust even after early September's sweeping structural rationalisation that slashed rates on 99% of the taxed items, giving North Block confidence it would eventually have to deal with only a modest and manageable shortfall from FY26 budget estimates.

Officials told ET the continued strength in GST collections demonstrates that the reforms are simultaneously underpinning local consumption and revenue buoyancy for the government.

"We are broadly aligned with budgeted revenues. Any deviation will be modest," a senior official told ET. The GST reforms, effective September 22, reduced the multi-layered tax structure to effectively two broad slabs of 5% and 18%, along with a special 40% rate for select items. The official cited above added that the government strategically timed the implementation date of GST rationalisation with the festive season, helping undergird domestic consumption.

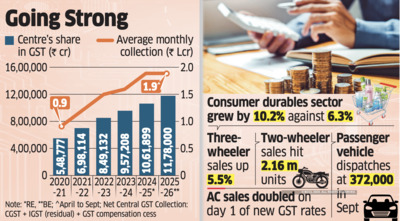

Three-wheeler dispatches increased 5.5%, while two-wheeler sales reached 2.16 million units in September.

Three-wheeler dispatches increased 5.5%, while two-wheeler sales reached 2.16 million units in September.

Healthy Business Activity

Passenger vehicle dispatches were at 372,000 in September and air-conditioner sales doubled on the very first day the GST reforms kicked in. TV sales saw a 30-35% increase.

“The positive takeaway is that demand has surged as intended, and revenue is still holding strong despite lower tax incidence,” said an official.

The Centre collected Rs 1.89 lakh crore as GST in September, up 9.1% year-on-year. Going by the available sales trends, the collection momentum likely kept up in October as well.

“The strong GST collections during the festive season clearly show that people are spending and business activity remains healthy," said Amit Maheshwari, Tax Partner, AKM Global, a tax and consulting firm. October collections would also be robust, he said.

However, both the government and tax experts believe that collections may soften once the festive season is over.

“Collections traditionally remain higher during festival season and December numbers will reflect the correct collection trend once the euphoria of the festivals settles down,” said the first official cited above.

The official added that the shortfall will not be as high as “speculated” by experts and economists and will be revenue neutral, compensated by higher than budgeted non-tax revenue.

Officials said the exact quantum of the shortfall may be correctly assessed only after December, having analysed the post-festive GST collection trends. Based on that assessment, the government may consider revising the budget estimates downward, if required.

The official added that the new GST registration and verification norms effective from November 1, including stricter authentication and physical verification for high-risk cases, are likely to plug revenue leakages and curb fake billing practices.

Economists say the shortfall would not impact overall fiscal math. “Given higher than budgeted non-tax revenues, and savings that typically tend to be found in expenditure relative to the budget estimates, we believe the government may be able to stick to its fiscal deficit target of 4.4% of GDP,” said Aditi Nayar, chief economist, ICRA.

Officials told ET the continued strength in GST collections demonstrates that the reforms are simultaneously underpinning local consumption and revenue buoyancy for the government.

"We are broadly aligned with budgeted revenues. Any deviation will be modest," a senior official told ET. The GST reforms, effective September 22, reduced the multi-layered tax structure to effectively two broad slabs of 5% and 18%, along with a special 40% rate for select items. The official cited above added that the government strategically timed the implementation date of GST rationalisation with the festive season, helping undergird domestic consumption.

Healthy Business Activity

Passenger vehicle dispatches were at 372,000 in September and air-conditioner sales doubled on the very first day the GST reforms kicked in. TV sales saw a 30-35% increase.

“The positive takeaway is that demand has surged as intended, and revenue is still holding strong despite lower tax incidence,” said an official.

The Centre collected Rs 1.89 lakh crore as GST in September, up 9.1% year-on-year. Going by the available sales trends, the collection momentum likely kept up in October as well.

“The strong GST collections during the festive season clearly show that people are spending and business activity remains healthy," said Amit Maheshwari, Tax Partner, AKM Global, a tax and consulting firm. October collections would also be robust, he said.

However, both the government and tax experts believe that collections may soften once the festive season is over.

“Collections traditionally remain higher during festival season and December numbers will reflect the correct collection trend once the euphoria of the festivals settles down,” said the first official cited above.

The official added that the shortfall will not be as high as “speculated” by experts and economists and will be revenue neutral, compensated by higher than budgeted non-tax revenue.

Officials said the exact quantum of the shortfall may be correctly assessed only after December, having analysed the post-festive GST collection trends. Based on that assessment, the government may consider revising the budget estimates downward, if required.

The official added that the new GST registration and verification norms effective from November 1, including stricter authentication and physical verification for high-risk cases, are likely to plug revenue leakages and curb fake billing practices.

Economists say the shortfall would not impact overall fiscal math. “Given higher than budgeted non-tax revenues, and savings that typically tend to be found in expenditure relative to the budget estimates, we believe the government may be able to stick to its fiscal deficit target of 4.4% of GDP,” said Aditi Nayar, chief economist, ICRA.

You may also like

Get clean and professional paint lines with handyman's caulk trick

Coffee machine is 'simply the best I've ever used' and now it's nearly half price

Arsenal latest: £35m 'next Robert Lewandowski' eyed as Declan Rice problem called out

15 players set to miss Tottenham vs Chelsea with both managers facing huge problems

Bihar polls: NDA's 24-point vision document promises employment, women's empowerment, industries